The Credo is not found in all Business Plans. I feel it is extremely important. It ties the company’s

Vision to the company’s

Mission and

Values Statements. The Vision could be seen as the way the entrepreneur sees his company in the future general business environment. The

Mission is what he intends to create to secure his place in the Vision. The Values statement indicates what the parameters of operation look like while attempting to achieve these goals. The Credo tells the reader how the company intends to execute these goals.

It could be seen as the way the objectives can be reached to realize the Mission inside of the Vision while adhering to certain Values.

A coherent Credo will allow the investor to understand a plan that he thinks has value but is not quite sure how to verify it. A Credo will also

help your employees understand, with practical examples, how to think about everyday business development. Here is an example of a successful Credo:

We are dedicated to those who use our products and services. In meeting their needs, we must produce quality services. Our objective is to serve our customers as they want to be served, providing quality services at reasonable prices. We must anticipate the technological advances in the market, continuously improving and developing our product and service line. Quality control must be an integral part of our process creating long-term relationships with our client base.

Our employees are respected as individuals and are compensated in a fair and adequate manner. We recognize their merit and respect their dignity. Development and advancement for those qualified will create an atmosphere where suggestions and complaints are possibilities for growth and unity. We must provide competent management, and their actions must be just and ethical.

Our final responsibility is to our shareholders. Business must make a sound profit. Research and Development is our future. We must purchase new equipment, new facilities and launch new products guaranteeing the investment of those who believe in our company. Reserves must be created to provide for adverse times. Our shareholders should realize a reasonable return when we operate according to these principles.

When a company does not stay in line it will most likely fail and in the best of cases have problems with the investors. Recently I looked at a company for a rather small investment. The teaser indicated that this company intended to recreate the Italian dining experience in a limited number of restaurants in the US. Their documentation indicated that they had several restaurants in Italy and had successfully developed a look, feel and service structure of a family owned Italian restaurant.

They listed the following reasons to support their plan:

Experience

More than fifty years combined experience in restaurants and Food & Beverage and have opened more than fifty restaurants world-wide.

Knowledge of Italian culture & cuisine

Knowledge of Italian culture & cuisine. Instrumental in the original Sfuzzi Concept and have lived and worked in Italy creating Hotels, Resorts and Restaurants.

Service level

We have developed a service training program “The Fine Art of Hospitality” to deliver impeccable customer service.

Product quality

We will utilize the efforts of accomplished Italian Chefs as we continue our involvement in Italy today.

However, they do not adhere to these concepts in everyday business decisions. I received a copy of a letter sent by a 30 year veteran of the wine business following an encounter with management evidencing numerous variations from the described plan. Some points that immediately caught my attention were:

Who is the audience you are seeking with your list in this resent incarnation? In other words, in the words of what we all do everyday, who is your target?

From our earlier conversation I thought you folks were looking to be an Italian experience that one would find in Italy.

Italian places don't usually serve Spanish or French wine. I can understand Texas wines because that is the region we are in and it is showing a connection to the region and her produce.

I don't understand having Pinot Noir on the list except to cash in on a trend that really has nothing to do with Italy (and which will pass). Ditto with Merlot. And Cabernet. Unless they are sourced from Italy, of which there are a lot of excellent choices.

From the expert’s comments I was able to identify what I felt was a primary flaw in the business model. The company was making the same mistake as most Italian restaurants in the US. It was attempting to use the idea of Italy as a marketing tool while providing an American experience. This model usually works well for low end places like Olive Garden, Campisi, and Macaroni Grill but fails for just about any other type of model that is not mass market.

In this particular example the company ignored the fact that Italian dining is not a flavor of food instead it is an experience and a way to see the world. While the mass market Italian places will cover everything with garlic, oregano, garlic, rosemary and more garlic and this works fine, a qualified Italian restaurant must use fresh ingredients, have knowledgeable staff, not turn tables, pair wines and generally recreate the concept of balance in life. This company was thinking about serving the mass market while telling his investors that he was trying to work in the quality niche segment.

His positioning in the mass market is fine, no problems, but the investors should be aware that this is his target so they can effectively evaluate his capability to compete with Brinker, YUM Brands, et al. It may be simply that the wine director of the restaurant was not completely aware of the company’s goals and objectives. Either way it does not matter, the end result is a company that says one thing and does another.

Tags: Small Business Private Equity Business Plans Financial Model Financing Marketing Sales

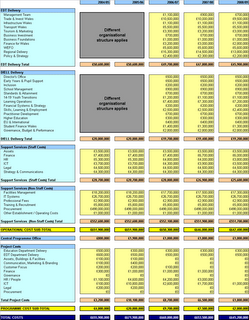

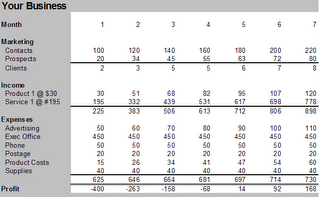

The financial model is the most often overlooked portion of a Business Model. When it exists it is usually a spreadsheet reassuming overall costs and overall revenues. It is prepared once with some assumptions thrown in and then forgotten. The financial model is one of the most important tools of a Business Plan. When done properly it will indicate how much money is really needed and if updated daily can let you know exactly where you are. Missing numbers is accepted on big companies because even when they miss rarely will their shortcomings determine a dire economic situation of the business.

The financial model is the most often overlooked portion of a Business Model. When it exists it is usually a spreadsheet reassuming overall costs and overall revenues. It is prepared once with some assumptions thrown in and then forgotten. The financial model is one of the most important tools of a Business Plan. When done properly it will indicate how much money is really needed and if updated daily can let you know exactly where you are. Missing numbers is accepted on big companies because even when they miss rarely will their shortcomings determine a dire economic situation of the business. A financial model will tell the story of your company in numbers. You could see it as a numeric version of your written Business Plan. Since writing a financial model is not intuitive for most entrepreneurs I strongly suggest you find a good modeler who is capable of understanding your business. It will cost you anywhere from $40-100 k but it is well worth the money. If you do not have that type of funds available, particularly in the start-up phase, look for a modeler who will take a piece of the company for the work he will do. It will take anywhere from 4-6 months to prepare an appropriate model but it should allow you to update data on a regular basis and return everything you need to run the business. Most importantly it will tell if you will really make money by implementing some procedure or by introducing a product.

A financial model will tell the story of your company in numbers. You could see it as a numeric version of your written Business Plan. Since writing a financial model is not intuitive for most entrepreneurs I strongly suggest you find a good modeler who is capable of understanding your business. It will cost you anywhere from $40-100 k but it is well worth the money. If you do not have that type of funds available, particularly in the start-up phase, look for a modeler who will take a piece of the company for the work he will do. It will take anywhere from 4-6 months to prepare an appropriate model but it should allow you to update data on a regular basis and return everything you need to run the business. Most importantly it will tell if you will really make money by implementing some procedure or by introducing a product. Each business is different but each business is the same. This is no more evident in any tool than with the financial model. This does not mean that you can just buy some model off the web but it does show the relationship between the various resources of your company. The financial model also tells you a great deal about the entrepreneur, how accurate his data is and whether or not he understands the various aspects of his business.

Each business is different but each business is the same. This is no more evident in any tool than with the financial model. This does not mean that you can just buy some model off the web but it does show the relationship between the various resources of your company. The financial model also tells you a great deal about the entrepreneur, how accurate his data is and whether or not he understands the various aspects of his business.