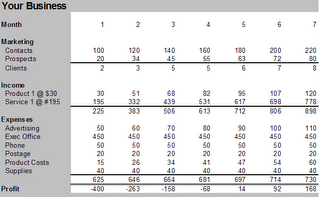

The financial model is the most often overlooked portion of a Business Model. When it exists it is usually a spreadsheet reassuming overall costs and overall revenues. It is prepared once with some assumptions thrown in and then forgotten. The financial model is one of the most important tools of a Business Plan. When done properly it will indicate how much money is really needed and if updated daily can let you know exactly where you are. Missing numbers is accepted on big companies because even when they miss rarely will their shortcomings determine a dire economic situation of the business.

The financial model is the most often overlooked portion of a Business Model. When it exists it is usually a spreadsheet reassuming overall costs and overall revenues. It is prepared once with some assumptions thrown in and then forgotten. The financial model is one of the most important tools of a Business Plan. When done properly it will indicate how much money is really needed and if updated daily can let you know exactly where you are. Missing numbers is accepted on big companies because even when they miss rarely will their shortcomings determine a dire economic situation of the business.With a start-up or small business this is not the case. With a good financial model, updated daily, and dynamic assumption fields the financial capabilities of the next six months will never be in question. Most people think of the financial model as a crystal ball. How can you know what will happen tomorrow? So they prepare numbers in a way that represents what they think someone else wants to see. This is a recipe for disaster and can mean not financing your company or receiving significantly fewer funds for a larger portion of the company. It is normal practice for a private equity firm to identify a problem in your model and give you what you ask for including some clause in the purchase contract that gives them first right of refusal or limits your ability to access alternative financing without their approval. You have, at this point, given away your time, and your company. You just are not aware of it yet.

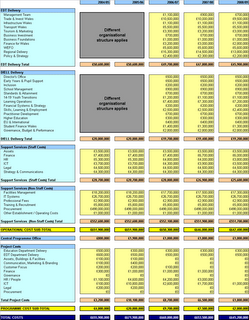

A financial model will tell the story of your company in numbers. You could see it as a numeric version of your written Business Plan. Since writing a financial model is not intuitive for most entrepreneurs I strongly suggest you find a good modeler who is capable of understanding your business. It will cost you anywhere from $40-100 k but it is well worth the money. If you do not have that type of funds available, particularly in the start-up phase, look for a modeler who will take a piece of the company for the work he will do. It will take anywhere from 4-6 months to prepare an appropriate model but it should allow you to update data on a regular basis and return everything you need to run the business. Most importantly it will tell if you will really make money by implementing some procedure or by introducing a product.

A financial model will tell the story of your company in numbers. You could see it as a numeric version of your written Business Plan. Since writing a financial model is not intuitive for most entrepreneurs I strongly suggest you find a good modeler who is capable of understanding your business. It will cost you anywhere from $40-100 k but it is well worth the money. If you do not have that type of funds available, particularly in the start-up phase, look for a modeler who will take a piece of the company for the work he will do. It will take anywhere from 4-6 months to prepare an appropriate model but it should allow you to update data on a regular basis and return everything you need to run the business. Most importantly it will tell if you will really make money by implementing some procedure or by introducing a product. Each business is different but each business is the same. This is no more evident in any tool than with the financial model. This does not mean that you can just buy some model off the web but it does show the relationship between the various resources of your company. The financial model also tells you a great deal about the entrepreneur, how accurate his data is and whether or not he understands the various aspects of his business.

Each business is different but each business is the same. This is no more evident in any tool than with the financial model. This does not mean that you can just buy some model off the web but it does show the relationship between the various resources of your company. The financial model also tells you a great deal about the entrepreneur, how accurate his data is and whether or not he understands the various aspects of his business.Tags: Small Business Private Equity Business Plans Financial Model Financing Marketing Sales Product Pricing